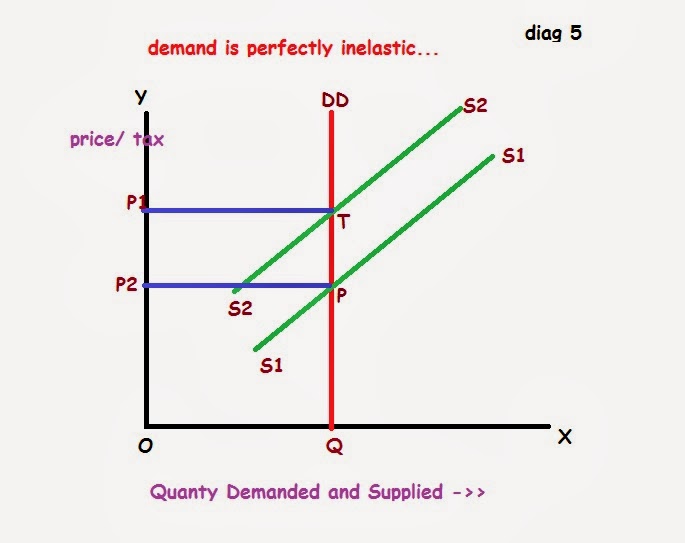

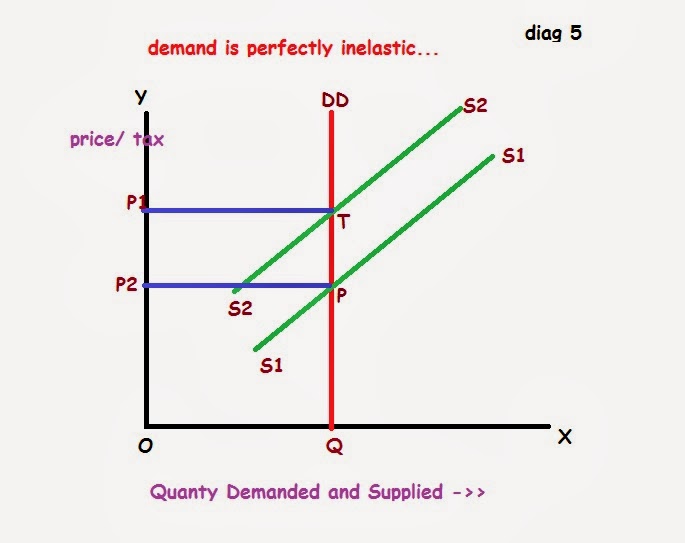

49++ Perfectly Inelastic Supply Tax Burden

Perfectly Inelastic Supply Tax Burden. Perfectly competitive industry) when do producers bear the entire burden of the tax? The buyer bears a greater portion of the tax burden when either demand is inelastic or supply is elastic, as depicted in diagrams # 1 and # 4, respectively.

New quantity traded, qt , the supplier gets $2 per unit (pts), the government. The amount of the deadweight loss varies with both demand elasticity and supply elasticity.when either demand or supply is inelastic, then the deadweight loss of taxation is smaller, because the quantity bought or sold varies less with price. The intuition for this is simple.

perceuse bosch jouet peigne vertical siemens pierre volcanique noire auvergne pare flamme poele a bois

Elastic Demand Economics Help

The imposition of a specific tax of $4 shifts the supply curve vertically by. If demand is more inelastic than supply, consumers bear most of the tax burden, and if supply is more inelastic than demand, sellers bear most of the tax burden. Taxes and perfectly competitive markets we have ignored the government’s role in the economy for a vast majority of the course. New quantity traded, qt , the supplier gets $2 per unit (pts), the government.

S = ∞[perfectly elastic supply] (e.g.: Tax incidence a company that issues bonds is essentially establishing a loan deal with an investor, and the company agrees to pay back the loan plus interest over a set timeline. This video shows how a tax burden is shared between consumers and producers when supply is perfectly inelastic. Taxes and perfectly inelastic demand..

If the scenario had been the opposite (i.e., the demand was perfectly inelastic), the consumers would have paid the entire tax burden. The amount of the deadweight loss varies with both demand elasticity and supply elasticity.when either demand or supply is inelastic, then the deadweight loss of taxation is smaller, because the quantity bought or sold varies less with price..

Given an upward sloping supply curve, the more inelastic is demand, the greater the fraction of the burden of taxation that is borne by consumers. If demand is relatively inelastic and supply is relatively elastic, then consumers bear more of the burden of a tax. Gets $4 also and the consumer pays $6. The problem is taken from principles of.